On July 21, 2023, PrimeSource Building Products, Inc. filed a Petition for a Writ of Certiorari with the U.S. Supreme Court, after unsuccessfully seeking an en banc hearing before all of the judges at the U.S. Court of Appeals for the Federal Circuit. In that decision, a three-judge panel reversed a lower court decision and

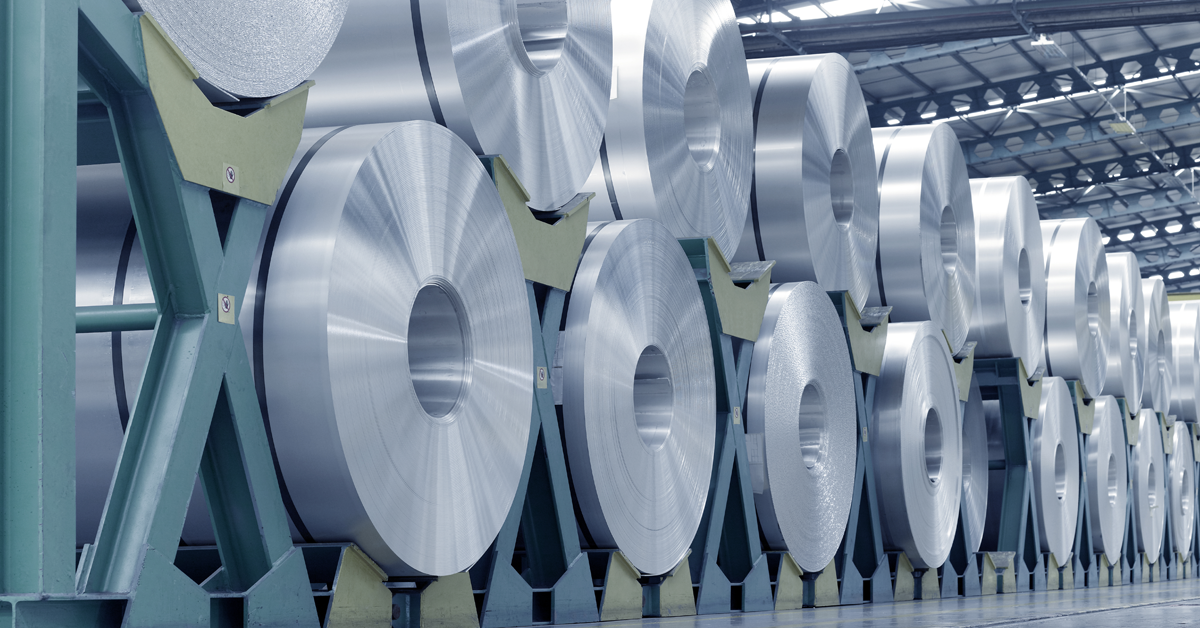

Aluminum

Plaintiffs Seek Full Federal Circuit Rehearing of Decision Allowing Section 232 Tariffs on Steel Derivatives

On April 24, 2023, plaintiffs in an ongoing challenge at the U.S. Court of Appeals for the Federal Circuit filed a Petition for Rehearing En Banc of their argument that former President Donald Trump improperly imposed additional Section 232 national security tariffs on derivatives of certain imported steel articles. In their petition for consideration by…

UPDATED: President Biden Issues Proclamations Increasing the Tariff Rates on Russian Aluminum to 200% and Significantly Increasing Rates on Other Russian Products

On the one-year anniversary of Russia’s invasion of Ukraine, President Joseph Biden on February 24, 2023, issued a Proclamation on Adjusting Imports of Aluminum Into the United States to implement: (1) effective March 10, 2023, a 200% import tariff on aluminum articles and derivative aluminum articles that are the products of Russia, and (2) effective…

Federal Circuit Reverses CIT Decision and Allows Section 232 Tariffs on Steel Derivatives

On February 7, 2023, a three-judge panel of the U.S. Court of Appeals for the Federal Circuit (CAFC) issued an opinion in PrimeSource Building Products, Inc. v. United States et al., Case No. 2021-2066, reversing a lower court decision and upholding the imposition of additional Section 232 national security tariffs on derivatives of certain imported…

U.S. to Increase Tariffs on Imports of Russian Goods; G7 Leaders Commit to Further Sanctions Against Russia

On June 27, 2022, President Joseph Biden issued a Presidential Proclamation announcing that the United States was increasing the duty rate to 35% ad valorem on certain products from Russia effective July 28, 2022. The White House indicated that this higher tariff will affect “more than 570 groups of Russian products worth approximately $2.3 billion”;…

U.S. International Trade Commission to Investigate Effects of Section 232 and Section 301 Tariffs on U.S. Industries

On May 5, 2022, the U.S. International Trade Commission (ITC) announced the initiation of a general factfinding investigation that will examine the impact of tariffs on U.S. imports under section 232 of the Trade Expansion Act of 1962 and section 301 of the Trade Act of 1974 in effect as of March 15, 2022. The…

U.S. and UK Announce Agreement on Steel and Aluminum Section 232 Tariffs

On March 22, 2022, the United States and the United Kingdom reached agreement on allowing “sustainable volumes” of UK steel and aluminum products to enter the U.S. market without the application of Section 232 tariffs. The Joint Statement notes that both the United States and UK will monitor steel and aluminum trade between the countries…

BIS Seeks Comments on Section 232 Steel and Aluminum Product Exclusion Process

On February 10, 2022, the Department of Commerce’s Bureau of Industry and Security (BIS) published in the Federal Register a Request for Public Comments seeking comments on the Section 232 product exclusion process, including the responsiveness of the process to market demand and enhanced consultation with U.S. firms and labor organizations. The request for comments…

United States and Japan Enter Steel Import TRQ Agreement to Address Section 232 Tariffs

On February 7, 2022, the United States and Japan announced an agreement to allow “historically-based sustainable volumes of Japanese steel products to enter the U.S. market without the application of Section 232 tariffs.” Under the agreement, the United States will implement a tariff-rate quota (TRQ) on steel imports from Japan, effective April 1, 2022. Under…

CBP Issues Guidance on EU Section 232 Tariff Rate Quotas on Imports of Aluminum and Steel Articles

On December 29, 2021, U.S. Customs and Border Protection (CBP) issued several guidance documents through its Cargo Systems Messaging Service concerning recent Presidential Proclamations that established the tariff rate quota (TRQ) process for imports of aluminum and steel articles from the member countries of the European Union (EU). See Update of December 29, 2021 for…